Rise & Fall of CPG Industry SPACs

SPACalicious definition make them CPG investors go crazy…it [was] hot, hot!

Fergie probably never envisioned a world where her song would be used to describe the SPAC trend, but whatever…

SPAC 101

SPAC = Special Purpose Acquisition Company

SPACs aren’t exactly a new thing with the first being formed in 1993. Moreover, SPACs are safeguarded versions of the 1980s "blank-check corporation" that had a terrible reputation and eventually became prohibited in the U.S. markets.

Despite SPACs being 30-years-old, they remained unpopular until 2020…

The creation of a SPAC flips the traditional initial public offering (IPO) process on its head. SPACs are formed to raise money through an IPO that is used to acquire another company later on. There is a two year deadline to complete an acquisition or the company must return the money to investors.

When the SPAC merges with another company:

Investors get shares/warrants in that merged company

Merged company gets a pile of money on its balance sheet for operational use

SPAC creators (sponsors) get a big chunk of the merged company as a reward

SPACs & CPG Industry (Pre-2020)

While SPACs didn’t really heat up until 2020, you might be surprised to know that there were a few notable ones used within the CPG industry years earlier.

2016 = Hostess Brands went public through the Gores Holdings. Inc. SPAC

2017 = The Simply Good Foods Company (owner of Atkins Nutritionals…and eventually Quest Nutrition) went public through the Conyers Park Acquisition Corp. SPAC

But then the SPAC market pretty much dried up for the CPG industry. Instead, those years saw many CPG brands being acquired by private equity or large CPG portfolios.

SPACs & CPG Industry (2020 -2023)

It wasn’t until mid-2020, when equity markets’ recovered from the initial shock of the pandemic, that it triggered a frenzy of SPAC activity for the next two years within the CPG industry.

20Q2 = Whole Earth Brands went public through the Act II Global Acquisition Corp. SPAC

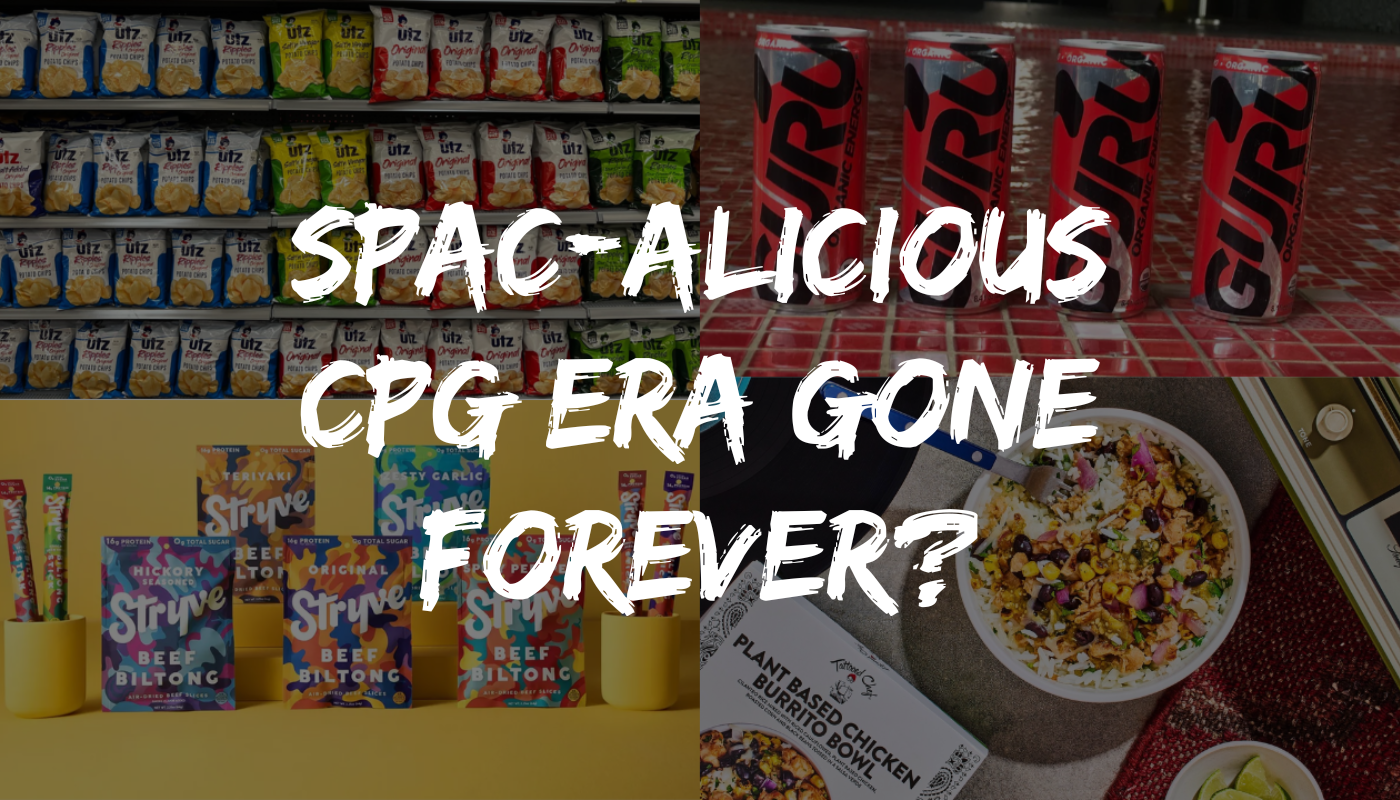

20Q3 = UTZ brands went public through the Collier Creek Holdings SPAC

20Q4 = The Tattooed Chef went public through the Forum Merger II Corporation SPAC

21Q1 = Stryve Foods went public through the Andina Acquisition Corp. III SPAC

22Q1 = Black Rifle Coffee went public through the SilverBox Engaged Merger Corp I SPAC

Even Canada was getting into the SPAC CPG fun, but they have a different name for it (i.e. Capital Pool Companies) and slightly different rules…

20Q4 = GURU Energy went public through the Mira X Acquisition Corp. CPC

SPACs Without a Deal

As mentioned earlier, there’s usually a two-year window within which a SPAC must complete a reverse merger with a target. Recognizing the constraints in the current market environment and the impracticality of meeting their merger deadline, some SPACs have liquidated and returned proceeds to their investors. Here are a collection of notable CPG-related SPACs that liquidated or still haven’t found deals

Authentic Equity Acquisition = sponsored by David Hooper (founding member of Centerview Capital)

HumanCo Acquisition Corp = sponsored by Jason Karp (Co-Founder at Hu) and Rohan Oza (Co-Founder of CAVU Vanture Partners)

Post Holdings Partnering Corporation = sponsored by Post Holdings

Importance of SPACs for CPG Industry

Based on current stock market performance compared to SPAC closing date price (it’s very poor BTW), it would make you think most of these SPAC deals caused companies to enter the public markets prematurely. And yes…there are certainly challenges of being a public company, but that doesn’t mean there aren’t CPG brands that are the right fit for going public via a SPAC merger. SPACs are complex investment vehicles, but could be advantageous in creating a more competitive investment environment for small to midsize CPG companies that are in growth mode. In many of the SPAC deals above, the CPG companies had the ability to accelerate CAPEX investments or seek M&A opportunities that potentially make them even more attractive to large CPG brands in the future.

What’s Next?

We will likely never see another SPACalicious period…and that’s probably a good thing. Just like SPACs were the remix of blank check corporations, I believe we will see a SPAC 2.0 in the near future. Market conditions will dictate timing but with much of the current SPACs unwinding in 23H1, it would provide an opportunity in the latter part of the year to introduce this new investment vehicle that might be better suited for CPG brands.